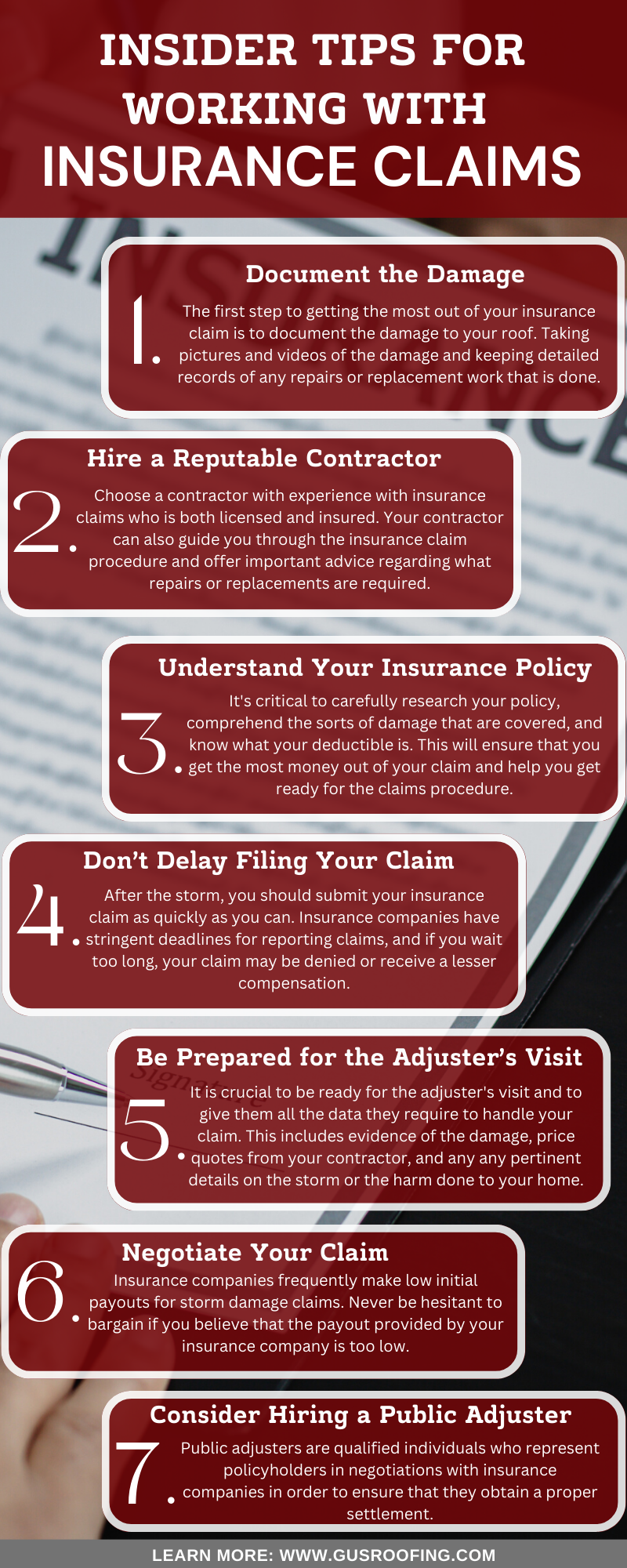

Insider Tips For Working With Insurance Claims

How to get the most out of them for storm damage to your home’s roof

If your home has been damaged in a storm, your first step should be to contact your insurance company and file a claim. However, dealing with insurance claims can be a stressful and time-consuming process, especially if you’re not familiar with the process. In this article, we’ll provide insider tips for working with insurance claims to get the most out of them for storm damage to your home’s roof.

Document the Damage

The first step to getting the most out of your insurance claim is to document the damage to your roof. This means taking pictures and videos of the damage and keeping detailed records of any repairs or replacement work that is done. Make sure to document all aspects of the damage, including any leaks, missing shingles, or other visible signs of damage. This will be helpful when you file your insurance claim and when you meet with your adjuster.

Hire a Reputable Contractor

Once you’ve documented the damage, it’s important to hire a reputable contractor to assess the damage and provide an estimate for repairs. Look for a contractor who is licensed and insured, and who has experience working with insurance claims, see here. Ask for references and check their online reviews to make sure they have a good reputation. Your contractor can also help you navigate the insurance claims process and provide valuable guidance on what repairs or replacements are necessary.

Understand Your Insurance Policy

Before filing your claim, it’s important to understand your insurance policy and what it covers. Many homeowners are surprised to learn that their insurance policy may not cover all types of storm damage, such as hail damage or wind damage. It’s important to review your policy carefully and understand what types of damage are covered and what your deductible is. This will help you prepare for the claims process and ensure that you receive the maximum amount of compensation possible.

Don’t Delay Filing Your Claim

It’s important to file your insurance claim as soon as possible after the storm. Insurance companies have strict deadlines for filing claims, and delaying can result in a lower payout or even a denial of your claim. Additionally, waiting too long to file your claim can make it more difficult to document the damage and prove that it was caused by the storm.

Be Prepared for the Adjuster’s Visit

Once you’ve filed your claim, your insurance company will send an adjuster to assess the damage to your home. It’s important to be prepared for the adjuster’s visit and to provide them with all the information they need to process your claim. This includes documentation of the damage, estimates from your contractor, and any other relevant information about the storm or the damage to your home. Be sure to ask the adjuster any questions you have about the claims process, and make sure you understand the payout process and what your responsibilities are.

Negotiate Your Claim

It’s not uncommon for insurance companies to initially offer a low payout for storm damage claims. If you feel that the payout offered by your insurance company is too low, don’t be afraid to negotiate. You can provide additional documentation, such as estimates from your contractor, to support your claim for a higher payout. If you’re not satisfied with the adjuster’s offer, you can escalate your claim to a higher-level manager or even hire a public adjuster to help you negotiate a better settlement.

Consider Hiring a Public Adjuster

If you’re having trouble navigating the insurance claims process or negotiating a fair settlement, you may want to consider hiring a public adjuster. Public adjusters are licensed professionals who work on behalf of policyholders to negotiate with insurance companies and ensure that they receive a fair payout. While public adjusters do charge a fee, they can be worth the cost if they can help you receive a higher payout than you would be able to negotiate on your own.

In conclusion, dealing with insurance claims for storm damage to your home’s roof can be a challenging and frustrating process. However, by following the insider tips we have discussed in this article, you can increase your chances of getting the most out of your insurance claim.

It is important to remember to document everything, from the initial damage to the repairs and receipts for expenses incurred. Be sure to communicate effectively with your insurance company and understand your policy coverage. And most importantly, do not hesitate to seek professional help from a public adjuster or roofing contractor.

With these tips in mind, you can navigate the insurance claim process with confidence and peace of mind, knowing that you are doing everything possible to protect your home and finances.

Need a roof inspection for your insurance claim? Contact us today: https://www.gusroofing.com/